Welcome to February, can you believe we’re already a month into 2016? Neither can we!

So far, 2016 has proven to be a busy year for us. We’ve already launched 3 new websites, and begun the design work for numerous others – including our own! Now, we just need to find the time to finish it up and launch it! With all these projects on our plate, we’re also starting to think about our taxes and how to best prepare for the year ahead.

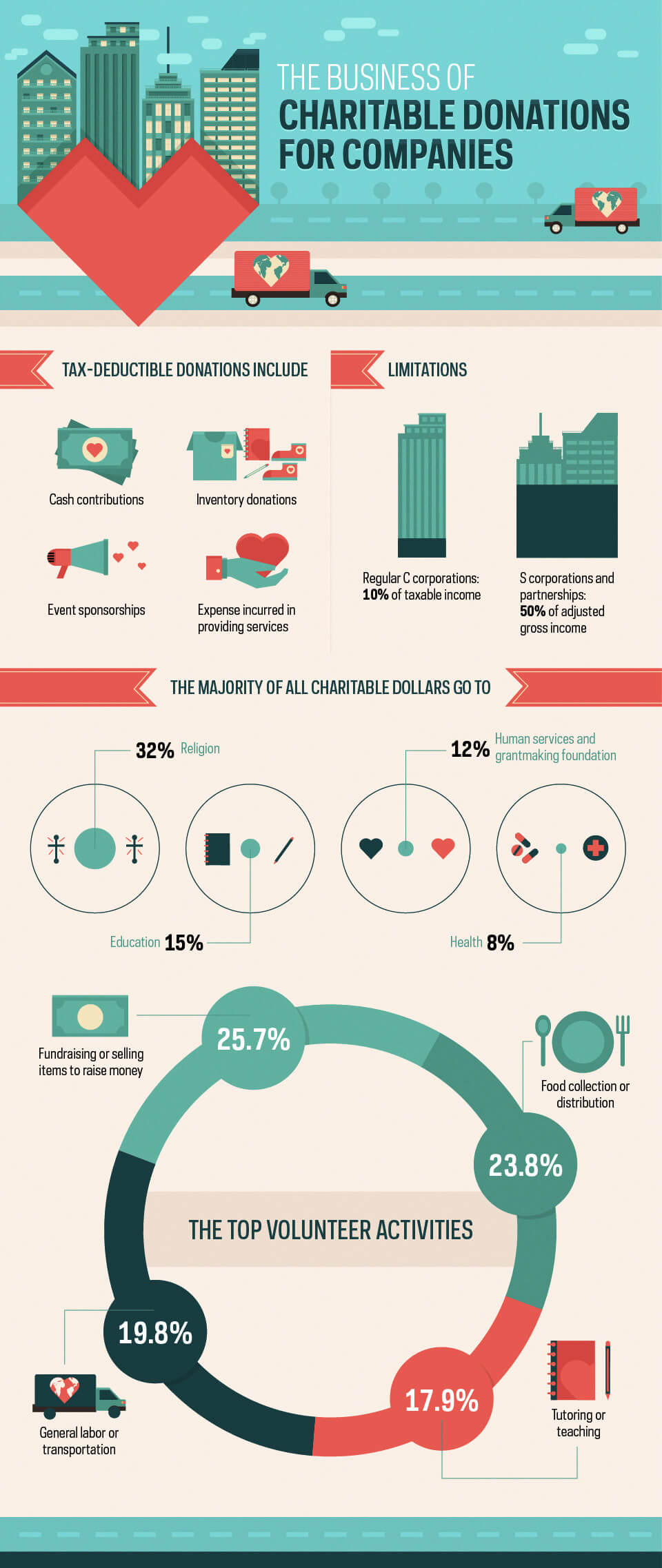

We’ve also been working on something many of you have been working on as well, our 2015 taxes. As a small business owner, this time of year can be confusing, making sure you’ve crossed all your t’s and dotted your i’s. We came across some interesting information from some tax accountants that we thought we’d share with you, as it could help you prepare your 2015 taxes.

It should help you understand 3 key areas:

- Charitable Donations

- Using a Vehicle for Business

- Saving for Retirement

It also provides information on healthcare expenses and other questions many small businesses have when they start gathering information together for their taxes.

Tax Details Accountants Wish Your Business Knew:

We hope it helps provide you with some helpful information as you prepare your 2015 taxes. Have anything else you’d like to add to it? Let us know below.

Frequently Asked Questions

Why are taxes such a challenge for small business owners?

Tax can be confusing for small business owners because they often involve multiple income sources, business deductions, and changing regulations. Keeping records organized and understanding what’s deductible can be overwhelming without professional guidance.

What are some common tax deductions small businesses should know about?

Common tax deductions include charitable donations, business-related vehicle expenses, retirement savings contributions, and certain healthcare expenses. Knowing how to properly track and report these can help lower your taxable income.

Can I deduct charitable donations from my business tax?

Yes, charitable donations made by your business may be deductible, but there are specific IRS guidelines you must follow. Be sure to keep detailed records and receipts to support these claims on your taxes.

How does using my vehicle for business affect my taxes?

If you use your vehicle for business purposes, you may be able to deduct mileage or actual vehicle expenses on your taxes. It’s important to keep a mileage log or detailed records of business-related trips.

Can saving for retirement help reduce my taxes?

Absolutely. Contributions to retirement plans like a SEP IRA, Solo 401(k), or traditional IRA can reduce your taxable income, offering both short-term and long-term financial benefits.